Robin Hood effect

The Robin Hood effect is an economic occurrence where income is redistributed so that economic inequality is reduced. That is a redistribution of economic resources due to which the economically disadvantaged gain at the expense of the economically advantaged.[1] The effect is named after English folkloric figure Robin Hood, said to have stolen from the rich to give to the poor.

The Robin Hood effect should not be mistaken for the Robinhood effect, which refers to the increasing significance and attention on small retail investors using trading platforms like Robinhood, characterized by their accessibility and low entry barriers.[1]

Causes

A Robin Hood effect can be caused by a large number of different policies or economic decisions, not all of which are specifically aimed at reducing inequality. This article lists only some of these.

Natural national development

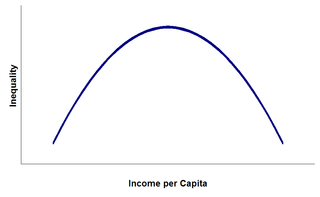

Simon Kuznets argued that one major factor behind levels of economic inequality is the stage of economic development of a country. Kuznets described a curve-like relationship between level of income and inequality, as shown. That theory prescribes that countries with very low levels of development will have relatively equal distributions of wealth.

As a country develops, it necessarily acquires more capital, and the owners of this capital will then have more wealth and income, which introduces inequality. However, eventually various possible redistribution mechanisms such as trickle down effects and social welfare programs will lead to a Robin Hood effect, with wealth redistributed to the poor. Therefore, more developed countries move back to lower levels of inequality.

Non-proportional income tax

Many countries have an income tax system where the first part of a worker's salary is taxed very little or not at all, while those on higher salaries must pay a higher tax rate on earnings over a certain threshold, known as progressive taxation. This has the effect of the better-off population paying a higher proportion of their salary in tax, effectively subsidising the less-well off, leading to a Robin Hood effect.

Specifically, a progressive tax is a tax by which the tax rate increases as the taxable base amount increases.[2][3][4][5][6] "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate.[7][8] It can be applied to individual taxes or to a tax system as a whole; a year, multi-year, or lifetime. Progressive taxes attempt to reduce the tax incidence of people with a lower ability-to-pay, as they shift the incidence increasingly to those with a higher ability-to-pay.

Cross-subsidisation of mobile telephony

In many developing countries, mobile communications networks tend to experience a large network externality, which regulators and operators seek to correct by subsidising subscriptions through increased prices for call termination. That then allows the less-well off in that country to gain access to communications services, often for free (on a prepay tariff). The additional cost is then levied on subscribers who make calls to these new subscribers; the call originators tend to be better-off. Therefore, despite there being no direct transfer of money, there is a strong Robin Hood effect, with the better-off subsidising the less well-off.

Counterfeit products

Counterfeiting is a typical problem faced by luxury fashion brands, resulting in the loss of hundred billion dollars every year. It can lead to the worsening of the brand reputation and can affect the development of new product. People knowingly buy counterfeits, with the primary intention of saving money, when they cite economical and moral justifications for the unethical behaviour. According to the legend of Robin Hood, he was vindicated because of the moral and financial justifications for his actions. Consequently, consumers seem to demonstrate the Robin hood effect when they purchase counterfeit products.[9]

Objective of Income Redistribution

The main objective of income redistribution is to increase opportunities for the less wealthy members of society while also increasing economic stability, and therefore income redistribution often includes funding for public services. The assumption for the need to redistribute income and wealth is based on the principle of distributive justice, which argues that money and resources should be distributed in the way that is socially just.

This is very strongly connected to the Robin Hood effect because public services are funded by money from taxes. So those who support redistribution of income argue for the need to raise taxes on the wealthier members of society in order to best support public programs serving the less well-off members of society.

Supporters of income redistribution argue that expanding the middle class is beneficial for the economy as a whole. By boosting purchasing power and ensuring equal chances for people to improve their living standards, a larger middle class can foster economic growth. Advocates of the Robin Hood effect contend that capitalism inherently generates unequal wealth distribution, necessitating corrective measures to ensure widespread prosperity.[10]

Examples from real world

Several Nordic nations, like Sweden and Finland, have effectively embraced the principles of the Robin Hood effect, leading to remarkably low levels of income inequality globally. Through a blend of progressive taxation on the affluent and comprehensive social welfare initiatives, these nations guarantee a commendable quality of life for their populace. The success of these strategies in fostering fairness and societal unity serves as a tangible demonstration of the tangible benefits achievable through the Robin Hood effect in practical contexts.[11]

Challenges

The idea of income redistribution has sparked a myriad of discussions and controversies. Opponents contend that overzealous wealth redistribution measures may hinder economic expansion and innovation by disincentivizing high achievers. They argue that excessively taxing the affluent and redistributing wealth could dampen entrepreneurial spirit and stifle investment, ultimately impeding overall economic growth.

However, proponents of income redistribution argue that reducing inequality is crucial for social stability and justice. They emphasize the importance of ensuring that everyone has access to basic necessities and opportunities for advancement, regardless of their socioeconomic background. Moreover, they assert that addressing economic disparities can lead to a more inclusive and prosperous society in the long run.

Finding the delicate equilibrium between mitigating inequality and fostering economic dynamism poses a formidable challenge for policymakers. Striking the right balance requires careful consideration of various factors, including the potential impact on incentives, productivity, and overall societal well-being. Policymakers must navigate these complexities adeptly to design effective strategies that promote both fairness and economic growth.[12]

Robin Hood effect and theories of economic justice

The Robin Hood effect aligns with normative economic justice theories, notably those centered on principles of redistribution to uphold fairness. Esteemed philosophers like John Rawls have championed redistributive measures as a pathway to ensuring equity and justice within society. According to these philosophical frameworks, disparities in social and economic status are ethically justifiable only if they serve to uplift the most marginalized segments of society. This concept strongly resonates with the rationale behind the Robin Hood effect, which seeks to rectify imbalances in wealth distribution by prioritizing the welfare of those with the least advantage. By embracing these normative theories, societies can strive towards a more just and equitable socioeconomic landscape, where opportunities and resources are more evenly distributed, fostering greater social cohesion and collective well-being.[13]

Robin Hood paradox

The Robin Hood paradox talks about wealth inequality in different stages of a country's development. Countries with lower development and low level of wealth will have less wealth inequality because of a more fairly equal distribution of wealth. As countries develop, the capital holders tend to benefit more from the growth of a country's economy, and thus increase the wealth divide between them and the ones that do not hold any or very little capital.[14]

Implications

The Robin Hood effect aims to reduce wealth inequality and economic disparity, but it also has multifaceted implications. It is definitely not Pareto efficient, in terms of economic efficiency as it could make higher-income individuals worse off. However, supporters of The Robin Hood effect argue that social benefits, such as increased opportunities for the poorer part of the population or enhancing economic stability, outweigh the inefficiencies.[15]

Cheer for the Robin Hood effect

When you give people a chance they are willing to sacrifice their own money to help the poor ones and punish the rich ones, that is the conclusion of the study that shows that egalitarianism is a natural human feature.

The team of scientists at University of California, set up a computer-based game to find out what motivates people to behave in a certain way, when it comes to harming others in a financial way, even if that means sacrificing their own resources. Twenty people were divided into four groups, with different incomes ranging from wealthy to poor. During every round of the game, players have a chance to anonymously spend money to decrease or increase another player’s income. After several rounds a noticeable pattern emerged. The poor ones got a helping hand while the rich ones suffered. Over 70 % of the money spent to lower someone's income were directed to rich players while around 60 % of the money spent to help someone were directed to rich players. Also the poorest players spent almost twice the amount of money draining incomes than the richest players did, while the rich players spent 77% more than the poorest ones to boost lower incomes.

So this study shows that desire for equality is at the root of many of our social behaviors. Experimental economics Erns Fehr says that this study supports the theory that equality is a widespread human desire. “This work helps explain why people get so upset when they discover someone is making $40 million a year and they’re not.” he says. [16]

Individuals contribution

There are several ways how individuals can contribute to the Robin Hood effect. Few of them are actively engaging in efforts to address economic inequality and social disparities, rooting for fair taxation policies or supporting initiatives that promote education and job opportunities for everyone.[17]

See also

- Income redistribution

- Distribution of wealth

- Economic inequality

- Federal taxation and spending by state

- Robin Hood

- Robin Hood tax

- Robinhood Markets

- Robin hood index

References

- ^ a b Boyle, Michael. "Robin Hood Effect: What It Is, How It Works". Investopedia. The investopedia team. Retrieved 2 April 2024.

- ^ Webster (4b): increasing in rate as the base increases (a progressive tax)

- ^ American Heritage Archived 2009-02-09 at the Wayback Machine (6). Increasing in rate as the taxable amount increases.

- ^ Britannica Concise Encyclopedia: Tax levied at a rate that increases as the quantity subject to taxation increases.

- ^ Princeton University WordNet[permanent dead link]: (n) progressive tax (any tax in which the rate increases as the amount subject to taxation increases)

- ^ Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), Concepts of Taxation, Dryden Press: Fort Worth, TX

- ^ Hyman, David M. (1990) Public Finance: A Contemporary Application of Theory to Policy, 3rd, Dryden Press: Chicago, IL

- ^ James, Simon (1998) A Dictionary of Taxation, Edgar Elgar Publishing Limited: Northampton, MA

- ^ Poddar, Amit; Foreman, Jeff; (Sy), Banerjee; Ellen, Pam Scholder (2012). "Exploring the Robin Hood effect: Moral profiteering motives for purchasing counterfeit products". Journal of Business Research. 65 (10): 1500–1506. ISSN 0148-2963.

- ^ Team, I. (2023b, September 27). Robin Hood Effect: What it is, how it works. Investopedia. https://www.investopedia.com/terms/r/robin-hood-effect.asp

- ^ Quickonomics. (2024, March 22). Robin Hood Effect Definition & Examples - Quickonomics. https://quickonomics.com/terms/robin-hood-effect/

- ^ The Robin Hood effect: Redistributing wealth for economic equity. (2024c, March 20). SuperMoney. https://www.supermoney.com/encyclopedia/robin-hood-effect

- ^ Quickonomics. (2024b, March 22). Robin Hood Effect Definition & Examples - Quickonomics. https://quickonomics.com/terms/robin-hood-effect/

- ^ Team, I. (2023, September 27). Robin Hood Effect: What it is, how it works. Investopedia. https://www.investopedia.com/terms/r/robin-hood-effect.asp#:~:text=The%20Robin%20Hood%20effect%20is%20when%20the%20less,gain%20at%20the%20expense%20of%20the%20less%20well-off.

- ^ The Robin Hood effect: Redistributing wealth for economic equity. (2024, March 20). SuperMoney. https://www.supermoney.com/encyclopedia/robin-hood-effect

- ^ Rooting out the Robin Hood effect. (2024, April 26). Science | AAAS. https://www.science.org/content/article/rooting-out-robin-hood-effect

- ^ The Robin Hood effect: Redistributing wealth for economic equity. (2024b, March 20). SuperMoney. https://www.supermoney.com/encyclopedia/robin-hood-effect